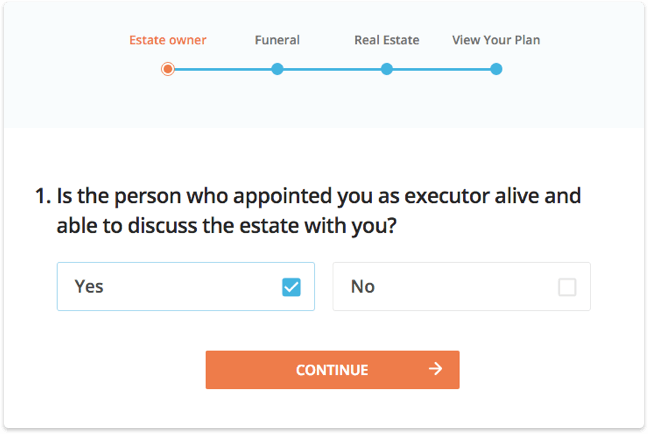

Want to better understand your executor duties?

You can save your plan and come back at any time.

Build My Custom PlanFeatured on

What are the duties of an executor?

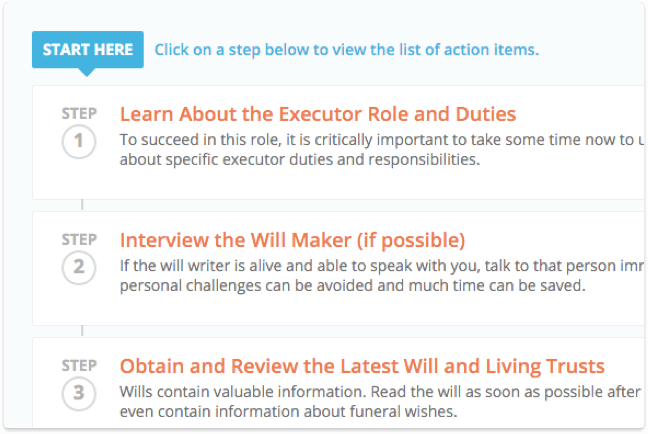

1. Learn about the Role and Responsibilities of an Executor

Before you dive into your executor duties, it’s a good idea to understand what your executor role will entail. An executor is a person named in a will to oversee the process of executing the deceased persons estate plan and distributing assets according to the will. Service as an executor – or estate administration – typically lasts around a year from start to finish, but the time varies depending on the size and complexity of the estate. As an executor you must act in good faith, but that does not mean you have to act alone. In fact, it’s best to hire an estate attorney to help you with all the legal forms and issues that must be handled. You may also need an accountant to manage required tax filings and a financial planner if the deceased person had one. The list goes on. Fortunately, the cost of hiring these professionals and law firms is covered by the estate. To help you complete the duties of an executor, we’ve come up with a list of the best online tools for executors.

2. If Possible, Interview the Will Maker

If a will-writer tells you that you are to serve as executor of that person’s will and that person is still living and able to speak with you about his/her wishes, you should talk with that person as soon as possible. You should ask the will-writer where the will (or living trust) is kept so you can easily get to it when the time comes. Also, get the will-writer to keep a list of financial assets with important details like account numbers and passwords. In addition to financial assets, items of personal or sentimental value should be recorded along with the story behind them. Professionals with whom the will-writer does business should be written down along with contact information and a brief description of what they do. With an executor.org plan, we’ll walk you through the questions you’ll want to ask the will maker. While not directly related to the will, it may be beneficial to talk with the will-writer about funeral plans and powers of attorney for health care during life. Further, knowing someone’s wishes regarding organ donation can be important to ensure his/her wishes are followed, even if those wishes are not written down in a will.

3. Obtain and Review the Latest Will and Trusts

When a person dies and you know you are the executor of will, one of your first duties is to get the original version of the latest will as well as any living trust documents the will-writer had. This is a good time to consider hiring an attorney, who can help you determine the validity of the will and how to proceed with filing it with the probate court. Probate lawyers can also be helpful if no will was written or the will cannot be found. A will often contains information not only listing the names of the beneficiaries but also including contact information for those beneficiaries. Make a copy of the will and use it to create a contact list for beneficiaries, checking to see if the contact information in the will is accurate. These beneficiaries should have access to a copy of the will as well. Since, as executor, you will be responsible for seeing that the wishes in the estate plan are followed, you should communicate an action plan to the beneficiaries. Throughout the process, it’s important to continue to keep the lines of communication open between you and the beneficiaries.

4. Hire the Relevant Professional Team to Support You

It’s unwise to approach the role of executor and its duties as something you have to do on your own. There are a lot of complicated steps involved from valuing assets and selling real estate to navigating the legal filings and paying the appropriate taxes. Beyond getting legal advice and hiring a law firm to help you in settling an estate, you may want to attend grief counseling. Chances are, if you’re named as the estate administration, you were close with the deceased person. It’s not uncommon to still be in the grieving process during your service in this role. Therefore, you may want to consider talking with a grief counselor or attending grief support group meetings during your service.

5. Plan and Manage the Funeral

Though the details of a funeral are not the responsibility of an executor, an executor is often seen as a person trusted by the deceased and may be consulted during the process of funeral planning. Since you are the executor, you need to keep in mind that every expense incurred comes out of the estate and affects the amount going to the beneficiaries. You do not have to be a penny pincher, but you should not spend freely without regard either. The process of planning a funeral involves many steps from selecting a funeral home itself to determining the details of burial/cremation and the service. This can be overwhelming for those closest to the deceased, so be prepared for them to turn to you for guidance and support.

6. Create a Detailed Record-Keeping System

There is a lot to keep up with during your service as executor. That is why it is important to keep everything organized and to take notes throughout everything you do. Depending on the will and your decisions, you may need to keep track of the amount of time you spend working on the estate. You should also keep track of the estate’s financial concerns and any expenses incurred as a part of your role as executor.

7. File the Will with the Probate Court and Obtain the Death Certificate

The process of getting a death certificate is generally quick if you have the right documentation. While name and date of birth might be easy items you think of as necessary, obtaining a death certificate may also require things like a social security card or number. When you get a death certificate, you should get several certified copies as well. You will have to use these throughout your service as executor. Shortly after the funeral, you should fill a will with the probate court. You should get an attorney to help you with this. The attorney can also help you understand any mandated court appearance requirements and further court imposed duties and deadlines.

8. Notify Necessary Organizations of the Death

One of the responsibilities of an executor to give the proper notice to organizations and individuals. This is not a task the executor has to embark on alone, though. An attorney can be helpful in giving proper notice, especially when creditors or business ventures are involved. There are many reasons to notify people and organizations of the death. It can stop benefit distribution so you don’t have to pay it back later. It can start the process for life insurance payments and other death benefits. It can even put you on alert for fraud, for example notification of credit card companies allows final bills to come without worrying if someone would fraudulently use the card number after the decedent’s death. Want a list of who you’ll need to contact, get an account and we can simplify the process for you.

9. Find, Value, and Protect Assets

With the help of the applicable professionals, assets should be documented along with their value. While it may seem self-explanatory to determine the value of bank accounts and other financial holdings, all personal and real property should be accounted for. Remember to stay organized and record everything you do. This is also a good time to remember to communicate with the beneficiaries to let them know what you are doing.

10. Manage the Estate, Eliminating Unnecessary Costs

The tasks involved in managing an estate after a person’s death are very similar to the tasks a person takes on during life. This can include creating a bank account in the estate’s name, paying bills and maintaining a home or other property. An important part of protecting assets involves making sure money in the estate is not being wasted. Unnecessary services such as television and internet, dues-paying memberships, magazine subscriptions, etc need to be cancelled in a timely fashion in order to keep as much money in the estate for the beneficiaries as possible.

11. Determine and Pay Debts of the Estate, Including Taxes

Consulting with the appropriate professionals when necessary to determine the legitimacy of a bill or debt, an executor is responsible for paying bills and debts owed by the decedent out of funds found in the estate. An executor is also responsible for seeing that income and estate tax returns are prepared and filed by the appropriate professional.

12. Create a Plan for Distribution or Sale of Personal Property

This is a task you should not embark on by yourself. Personal property ranges from simple items like clothes and shoes to large or valuable items such as jewelry and cars. You should get a professional to value the assets so when the beneficiaries express an interest in particular ones, you can distribute as fairly as possible. You should spend some time thinking through how personal property will be divided and communicate the process in advance to the beneficiaries. There will be personal property that none of the beneficiaries want, so you will have to oversee the sale or donation of the items.

13. Sell the Real Estate

Often, real estate is the most valuable part of a decedent’s estate. This makes it all the more important that you consult with professionals during the sale process. You should communicate with the beneficiaries as well because the sale of a home may affect how quickly or slowly the personal property inside can be distributed.

14. Distribute Estate According to Will and Close the Estate

When assets are valued, interests of beneficiaries in personal property are determined, and debts are paid, you should next distribute the estate’s assets according to the will. To do so, you should calculate the value of the estate and the value of each beneficiary’s share. Assets can then be distributed. Once this is done, work with the estate’s attorney to wrap up the probate process with the court.

15. Plan your Own Estate

You’ve learned a lot while serving as an executor. You’ve made valuable connections with professionals. You’ve seen what sorts of things you might want to incorporate for yourself and things you would want to avoid. It’s now time to put that knowledge to good use and plan your own estate.